Tax

Understanding tax strategies and managing your tax bill should be part of any sound financial approach. Some taxes can be deferred, and others can be managed through tax-efficient investing. With careful and consistent preparation, you may be able to manage the impact of taxes on your financial efforts.

Making Your Tax Bracket Work

Have you explored all your options when it comes to managing your taxable income?

Have A Question About This Topic?

How to Make the Tax Code Work for You

When you take the time to learn more about how it works, you may be able to put the tax code to work for you.

Tax & Estate Strategies for Married LGBTQ+ Couples

Learn how to maximize your tax and estate strategy as a married member of the LGBTQ+ community.

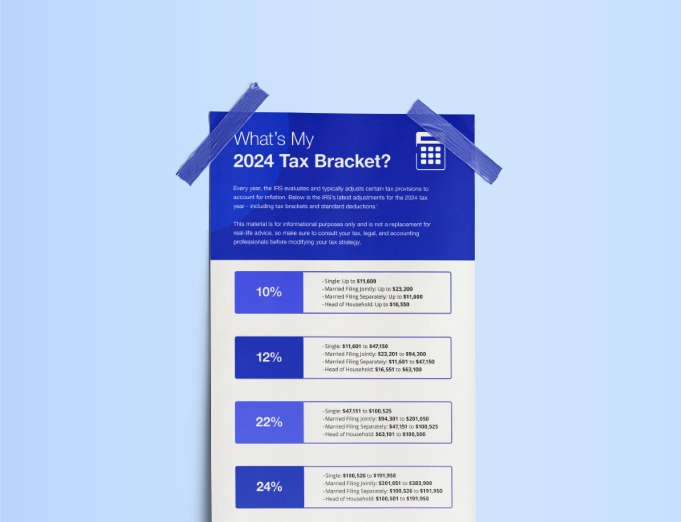

What’s My 2024 Tax Bracket?

Check out this handy reference of updated ranges from the IRS in case your designated bracket has changed.

You May Need to Make Estimated Tax Payments If…

Have income that isn’t subject to tax withholding? Or insufficient withholdings? You may have to pay estimated taxes.

What’s My 2024 Tax Bracket?

Check out this handy reference of updated ranges from the IRS in case your designated bracket has changed.

Capital Gains Tax When Selling Your Home

If your clients are buying or selling a home, use this to help them determine if they qualify for capital gains taxes.

How Income Taxes Work

A quick look at how federal income taxes work.

Filing Final Tax Returns for the Deceased

The federal government requires deceased individuals to file a final income tax return.

Tax Rules When Selling Your Home

The tax rules governing profits you realize from the sale of your home have changed in recent years.

View all articles

Comparing Investments

This calculator compares the net gain of a taxable investment versus a tax-favored one.

View all calculators

Making Your Tax Bracket Work

Have you explored all your options when it comes to managing your taxable income?

View all videos

-

Articles

-

Calculators

-

Videos